An overview of the certification process for FCC, CE, and similar certifications. Useful to anyone manufacturing Android hardware like tablets and phones.

Continue readingFCC Certification – The Testing Process

A detailed look at obtaining FCC certification (Federal Communications Commission) which is needed for electronic products that are sold in the US.

Continue readingLessons From Custom Android Device Manufacturing

Read about the lessons we’ve learned from doing custom device manufacturing and learn why prototyping is such an important stage in the development of your custom Android device.

Continue readingRugged Android Tablet Testing

Take a look at the different stages and methods of rugged tablet testing, with a special focus on custom Android tablets, smartphones, and devices.

Continue readingNext-Gen Low Cost Chipsets

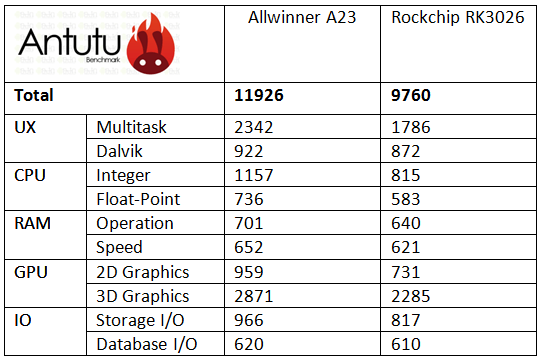

Allwinner vs Rockchip

As component prices fall and technology improves, we are beginning to see more and more smart products at very affordable prices. IC (integrated circuit) companies, OEM’s (original equipment manufacturers) and retailers alike are all pushing for higher performance in their low end product lines and this is being made possible because of the drop in component prices. IC companies are beginning to make a real impact by releasing new SoC’s (System on a Chip) that are very powerful yet inexpensive and have lower power consumption. These new chipsets have allowed manufactures to produce smartphones at record low prices and it has opened up a whole host of opportunities for other low cost smart devices.

To many companies in the android market the IC chipset or SoC, is the linchpin within the supply chain. It is fundamentally the brain of any product. Further, its performance and price dictate the type of smart device that can be created. As low cost / high performance SoC’s are released we are seeing a greater shift in the market. Manufactures are for the first time being able to create much lower cost higher performance smart products.

Benchmark Testing

In September we saw the release of two comparable, low priced SoC’s from two of the top Chinese IC companies, Allwinner and Rockchip. Only one month after their official release’s OEM’s launched tablet solutions powered by these chipsets. Hatch performed key benchmark testing for samples of both chipsets, the A23 from Allwinner and RK3026 from Rockchip.

On paper the main difference when looking at a direct comparison is the CPU architecture. Rockchip is using the newer more powerful ARM® Cortex™-A9 architecture and is clocking a frequency of 1GHz, whereas Allwinner has the power efficient ARM® Cortex™-A7 clocking at 1.5GHz. They have both chosen to use the same GPU, ARM Mali-400 MP2 Dual Core graphics engines, making a head-to-head performance test all the more interesting.

Allwinner has far higher on-chip integration because of MIPI DSI meaning there are more components on the SoC so developers can have less system components. A higher on-chip integration allows for lower product costs and a more stable and efficient PCBA board. Rockchip on the other hand has potential cost saving benefits with Pin to Pin compatibly with the single core RK2926. This means that manufactures will not have to change the PCBA layout to accommodate the newer chipset. This will be attractive for existing developers as upgrading from previous PCBA designs to dual core will be less expensive and faster to market.

The results of the benchmarking made a clear distinction between the seemingly similar SoC’s. Here’s what we found!

Antutu Benchmarks

Looking at the Antutu Benchmark scores it is clear that the A23 has outperformed the RK3026. This is due to a number of key differences in their design. First the Allwinner clock speed has a 50% premium on the Rockchip which instantly makes a difference in performance. You might say that as the Rockchip has used the more powerful ARM® Cortex™-A9 architecture this performance difference will balance out, but the CPU architecture isn’t the only factor at play when gauging performance.

Allwinner has invested in optimizing the A23 SoC’s system design allowing for better performance and more efficiency. Also, DDR and GPU design enhancements have been made within the SOC that have positively affected the performance. Further, the A23 utilizes a low power output specifically with audio and video playback at 50mA due to the use of the more efficient ARM ® Cortex™-A7 architecture. We think this will certainly be attractive for developers entering into the tablet space.

This being said what makes the RK3026 still stand out as a top SoC for developers is the 2G communication support allowing for cellular-wireless connectivity in next generation budget tablets and low cost smartphones. But as of this month Allwinner will release the A23 with 2.75G connectivity. We will have to wait and see which solution comes out on top, but some industry experts believe the A23 has more specific peripheral communication interfaces. This advantage in communication interfaces could gain the A23 more industry support than the RK3026. Looking at the unit price they are fairly comparable but the RK3026 PCBA cost has a slight advantage being cheaper by 2-3%. As this is marginal we don’t think it will affect a developers decision but it could make a difference.

After reviewing the two SoC’s it’s clear that we are seeing two great, aggressively priced consumer level platforms. Choosing between the two really depends on your application. If you want a more powerful, more efficient SOC, go with the A23. However, if you are looking for a smoother transition when upgrading from the single core RK2926, then the dual core RK3026 is the right SOC for you.

High Efficiency Flash Memory Testing

Increased demand for flash memory has allowed the cost per GB to fall and opened up the market to many smaller manufacturers and distributors. But as the availability of lower cost flash increases so does the amount of counterfeit and low quality flash. For an OEM, being extra vigilant when managing the quality of lower end flash is critical. This will happen at various stages throughout the production process but weeding out the defects at the beginning is far more efficient. You can find a select number of under-the-radar testing centers available to ensure you are providing quality flash in your product while still retaining the higher margin gained from cheaper flash.

These intimate testing centers hook up 20+ computers linked to 8-piece units custom-made for testing flash. With a capacity of 60 units they can churn out at a rate of 15,000 pieces per day for 4GB flash. With this extra QC step you are able to take out 85% of the defects in the initial stage and then later during assembly find the remaining defective 15%. This extra step in an OEM’s arsenal has allowed them to buy at lower cost but still guarantee the quality of their products.

The Rise of Flash

The development of flash memory in the mid ‘80s had a profound impact on the data storage industry. This development offered a critical step forward in storage capability which later became the catalyst for a significant revolution in mobile personal computing devices, including PDAs, mobiles phones, gaming devices and media players. No one could have predicted how big the impact flash memory would have on the technology industry.

NAND flash memory has emerged as the leader in this high-density silicon storage arena. Sales of NAND Flash have been growing year-on-year and are outperforming DRAM as the demand for media tablets and Smartphones continues to increase. NAND flash sales are set to increase 14% annually from 2013-2017, growing to US$53.2 billion at the end of the forecast period while the DRAM market is forecast to grow 9% annually over the same time.